On Tuesday, the World Gold Council (WGC) said that gold prices near record highs could dampen demand in India during the peak festival season and lead to the lowest purchase volumes in three years.

India is the world’s second-largest gold consumer, and a plunge in purchases could limit a rally in international prices. Declining demand for gold imports could also help narrow India’s trade deficit and support the rupee.

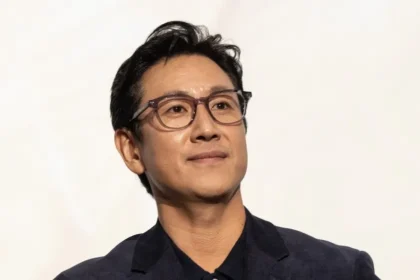

Somasundaram PR, regional chief executive officer of WGC’s Indian operations, said that higher prices in the December quarter, which traditionally witnesses the highest sales of the year, could cut back purchases.

Gold demand in India usually boosts towards the end of the year, which coincides with the traditional wedding season and main festivals including Diwali and Dusherra, when bullion buying is considered auspicious.

Local gold prices jumped this week to 61,396 rupees per 10 grams, near the all-time high of 61,845 rupees hit earlier this year. Last year, prices in the December quarter were almost 20 percent lower than this year.

Somasundaram said, in the December quarter, demand is expected to be lower than last year’s 276.3 metric tons.

He said, “Currently, price is a significant influencer. If there is a substantial price drop closer to Diwali, the entire situation could change.”

Indian gold consumption in the July-September quarter increased 10 percent to 210.2 metric tons, as both jewelry and investment demand enhanced due to a correction in local prices, he said.

From January to September, gold demand dropped by 3.3 percent to 481.2 metric tons due to sluggish demand in the first half.

Demand could fall to around 700 metric tons in 2023, the lowest in three years, down from 774.1 metric tons a year ago, he said.

The WGC data showed that higher gold prices have been pressing some people to sell their old jewelry and coins, leading to a jump in scrap supplies by 37 percent from a year ago to 91.6 tons in the first nine months.

Somasundaram said that the trend would continue in the December quarter if prices remained around the current level.