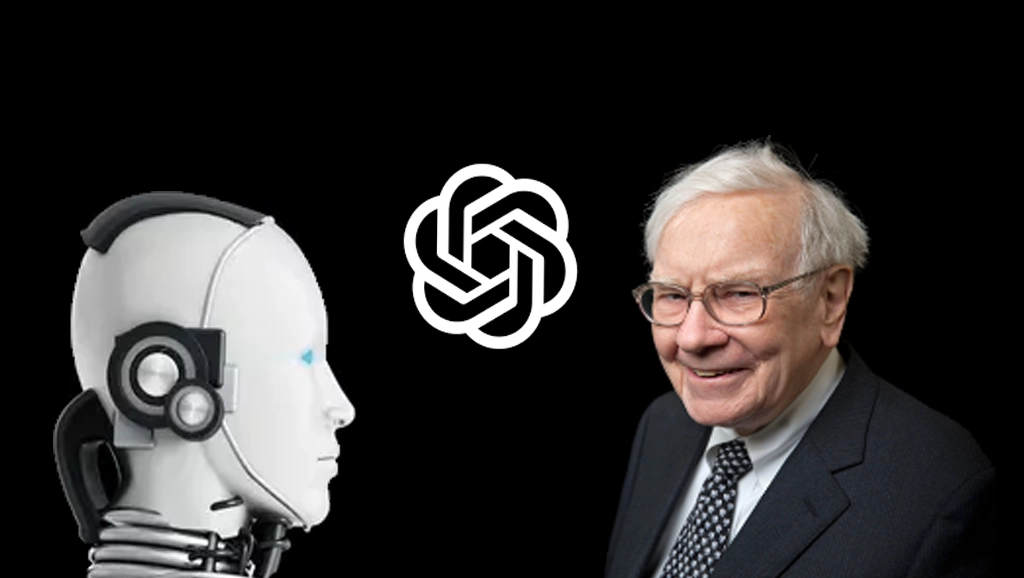

ChatGPT, in which Microsoft company invested $10 billion, is spread in the tech universe as the day passes. Investors and businessmen utilize it for their business strategies and investing strategies to grow their respective businesses. ChatGPT has delivered its knowledge and has shown its ability in writing stories, and in an email that announces the dismissal of employees.

As you know, ChatGPT has an approach to strategies of Warren Buffet’s strategies. So I decided why shouldn’t I ask the question about Warren Buffett’s investing strategy which helped him to reach billionaire status, after a couple of seconds the answer shook me up as it stated;

Investing Strategies

“Warren Buffett’s leading and important strategy of investment is value investing. He understands what will happen if I invest in this company which means he identifies undervalued companies with strong potential for growth and a durable competitive advantage and then holds onto those investments for the long term. He also follows a principle of investing in businesses he understands, with a focus on companies with predictable earnings and a strong track record of increasing profits.”

Future Stocks

Well, the answer was a bit true. Then I asked ChatGPT the same question as Insider Phil Rose asked, Which stocks Buffett could add to his portfolio?

Then ChatGPT named two stocks that could make sense for Warren Buffett to invest in the future, they were PepsiCo and Unilever. It may be weird but famously Buffett drinks five cans of Coke a day, but he hadn’t consumed a can of Pepsi for over years. It will be a surprise to see, Will Warren Buffett adds PepsiCo to his portfolio. While he hadn’t consumed it for 50 years. While for Unilever, In 2017, Buffett was too close to sweeping the deal on the Unilever company along with Kraft Heinz, but its collapsed.