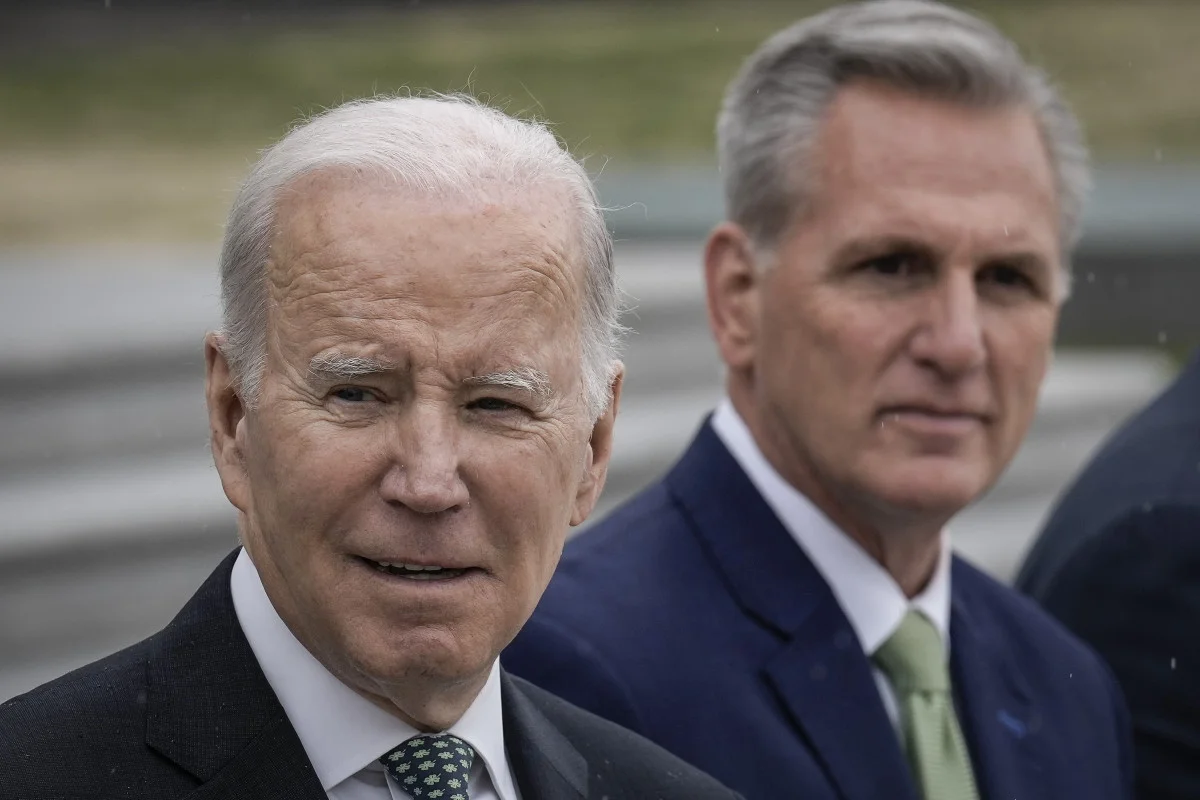

In a crucial development for the nation’s economy, top Republican lawmaker Kevin McCarthy has stated that negotiations with President Joe Biden regarding the US federal government’s debt ceiling are showing signs of progress. However, with the imminent risk of default just a week away, time is running out to reach a resolution.

The Treasury Department recently announced that the government’s funds would be depleted by June 5, leaving the nation at risk of default unless Congress takes swift action. This revised deadline, although slightly later than previously anticipated, adds a sense of urgency to the situation.

While progress has been made between Biden and House Speaker McCarthy, the process of turning any deal into legislation is expected to face significant challenges due to the divided and acrimonious nature of Congress. McCarthy informed reporters that while a deal has not been reached, there has been notable progress and negotiations are ongoing.

On one side, hardline Republicans have issued threats to block any bill that falls short of their expectations, which primarily include substantial spending cuts. Meanwhile, progressive Democrats have expressed concerns over compromises involving new work requirements for federal anti-poverty programs, potentially withholding their support.

Despite the challenges, President Biden remains optimistic, stating that a deal is “very close.” However, with Republicans holding a slim majority in the House and Democrats maintaining a narrow Senate majority, passing any agreement into law requires delicate navigation.

Republicans have long aimed to curtail government spending to address the growing US debt, which currently matches the annual output of the economy. However, the expected agreement is projected to fall significantly short of their ambitious goals.

The tentative agreement, as it stands, involves raising the debt ceiling to cover the nation’s borrowing needs until the November 2024 presidential election. The agreement would also include increased spending on the military and veterans’ care, while capping spending for many discretionary domestic programs.

Notably, Republicans are pushing for energy permitting reforms, including easing restrictions on gas and oil drilling. However, even before a deal is reached, some members of McCarthy’s caucus have voiced objections, expressing concern over extending the debt ceiling through the next presidential election.

Sticking points in the negotiations include Republicans rejecting Biden’s proposed tax increases and both sides showing reluctance to address the fast-growing health and retirement programs that contribute to the escalating debt.

The consequences of a failure to raise the debt ceiling before June 5 would be severe, potentially triggering a default that could significantly impact financial markets and push the United States into a deep recession. Credit-rating agencies have placed the US on review for a possible downgrade, which would raise borrowing costs and undermine the country’s position as the pillar of the global financial system. A similar standoff in 2011 resulted in Standard & Poor’s downgrading the US debt rating, causing market turmoil and increased borrowing costs for the government.

As the clock ticks, the nation’s eyes remain fixed on Congress, eagerly awaiting a resolution that will avert a catastrophic default and provide stability for the US economy moving forward.