On Thursday, official data showed China’s consumer price inflation last month slipped to its lowest level in a year as the country occurred from tough pandemic controls and a Lunar New Year spending binge.

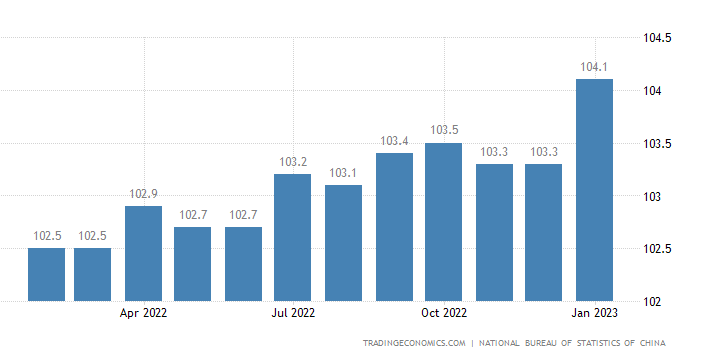

According to the country’s National Bureau of Statistics (NBS), February’s consumer price index (CPI) which is the main gauge of inflation, increased by one percent, down from a 2.1 percent annual rise in the first month of the year. The latest figure is the lowest since February 2022.

NBS statistician Dong Lijuan said the fall was caused by a “decline in consumer demand after the holidays as well as satisfactory supply in the market”.

While a drop was expected, experts polled by Bloomberg ahead of the data’s release had expected the CPI to hit 1.9 percent. Analysts say the fall was produced by lowering food prices and cautious spending behavior, despite China’s reopening to the world after three years of its rigid zero-Covid policy.

This casts doubt on the strength of domestic demand recovery in the household sector. It also “contradicts” other indicators that a strong rebound may be in the works. Nonetheless, the weak CPI inflation opens room for the government to launch more monetary easing policies.”

Zhang Zhiwei-President of Pinpoint Asset Management

China has been fairly sheltered from skyrocketing international prices and the wider economic fallout from Russia’s invasion of Ukraine. But economists still predict consumer prices in China to grow in the coming months as the country appears from the pandemic era and spending returns to normal.

Meanwhile, data released on Thursday by the NBS showed that the producer price index, which measures the cost of goods leaving factories, dropped 1.4 percent from a 0.8 percent contraction in January, especially in line with market anticipations.

Chinese authorities announced an economic growth goal of “around five percent” for 2023 on Sunday, as the country’s annual rubber-stamp parliament kicked off in Beijing. The world’s second-largest economy grew three percent last year, skipping its target of around 5.5 percent in the face of strict Covid policies and a spiraling crisis in the property sector.