WASHINGTON — Federal Reserve Chair Jerome Powell signaled on Wednesday that further interest rate cuts this year may be out of reach, citing internal policy disagreements and a lack of crucial economic data due to the ongoing federal government shutdown.

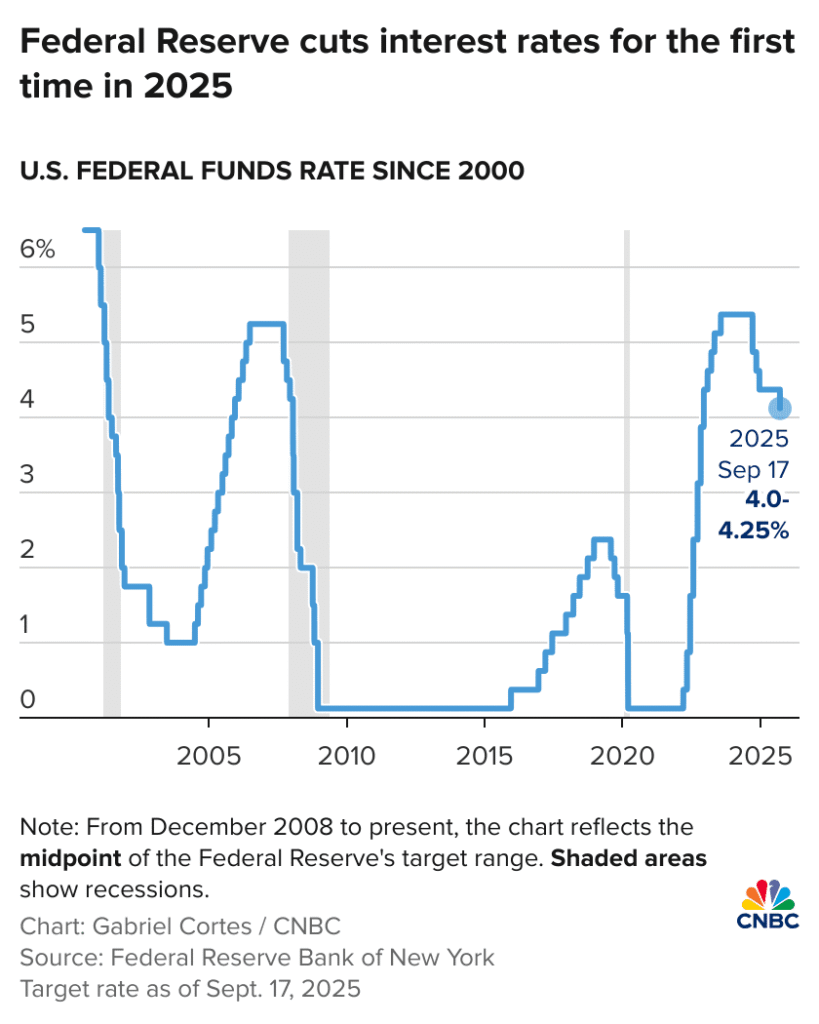

The Fed reduced its benchmark interest rate by a quarter of a percentage point, as expected, bringing it to a 3.75%-4.00% range. However, Powell stressed that missing job and inflation reports could make policymakers more cautious in deciding the next steps.

“We’re going to collect every scrap of data we can find, evaluate it and think carefully about it. And that’s our job,” Powell said during a press conference following the Fed’s two-day policy meeting.

Powell highlighted that the shutdown has prevented the release of essential economic indicators, prompting the Fed to rely on private data, in-house surveys, and informal interviews with business contacts to guide policy decisions.

He added that internal divisions within the Federal Reserve complicate the decision-making process, with “a growing chorus” of officials advocating a pause before further rate cuts. The latest vote on the rate cut was 10-2, with dissents from Fed Governor Stephen Miran and Kansas City Fed President Jeffrey Schmid, reflecting the range of opinions on the committee.

Financial markets responded by lowering expectations of another cut at the December 9-10 meeting, now giving roughly two-to-one odds. Michael Pearce, deputy chief U.S. economist at Oxford Economics, noted that Powell’s remarks “explicitly signaled a break between this and future meetings,” indicating careful consideration before additional easing.

Powell described the current policy rate as “modestly restrictive,” helping to temper inflation pressures. While he expects inflation to rise temporarily due to import tariffs, he projected a gradual decline toward the Fed’s 2% target.

The Fed also announced it will resume limited purchases of Treasury securities after money markets showed early signs of liquidity stress. This move will maintain the central bank’s $6.61 trillion portfolio while reinvesting proceeds from maturing mortgage-backed securities into Treasury bills.

Powell emphasized that the Fed’s approach is not on a preset course: “A further reduction in the policy rate at the December meeting is not a foregone conclusion…policy is not on a preset course.”